Marketers have always found it challenging to justify spend and push for increased budgets. Here are 6 calculations to help measure success and encourage marketing investment.

1. Customer Acquisition Cost (CAC)

This metric reveals the average money spent to acquire each new customer, based on sales and marketing budget. This is calculated by dividing the total marketing and sales costs (including campaigns, salaries, agency fees etc.) within a specific time period, by the total number of new customers within that same period. The resulting number will be the average cost of acquiring each new customer.

Let’s say your marketing costs for the last month are £5,000, and you gain 35 new customers, then: £5,000 ÷ 35 = £142.86 spent per new customer. Generally speaking, the lower the CAC the better, but that doesn’t necessarily mean budgets should be cut. If a business’ CAC is staying the same or slowly growing, but a lot of resource is being put into marketing, this might be a sign to update marketing strategies to better suit changing consumer tastes.

2. Customer Attrition Rate

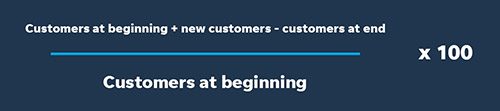

The customer attrition rate (CAR) is the percentage loss of customers to a business during a specific time period. The lower the percentage, the better. To calculate the CAR, simply add the number of customers at the beginning of a time period with the number of new customers acquired, then subtract the number of customers at the end of that period, and divide this by the number of customers at the beginning of the period, then times by 100. Here’s a visual representation:

If you started the month with 65 customers, and acquired 20 new customers, and finished the month with 75 customers, then 65 + 20 – 75 = 10; 10 ÷ 65 = 0.15; 0.15 x 100 = 15%. The lower your attrition rate, the better you’re doing with retaining customers.

3. Customer Retention Rate

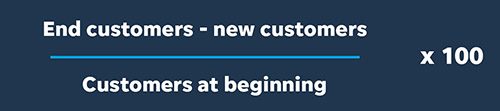

The customer retention rate (CRR) measures the percentage of customers a company has retained over a given period. Generally speaking, the higher the retention rate, the better as it costs less to keep repeat customers than it does to find new ones. CRR can be calculated by taking the number of existing customers from the number of new customers, and dividing that by the number of customers at the start of the time period, then multiplying by 100.

As an example, if we use the same numbers from calculating the previous metric: 75 – 20 = 55; 55 ÷ 65 = 0.85; 0.85 x 100 = 85% CRR. If you’ve already calculated the CAR, then an easier way to calculate the CRR is simply by taking the CAR number from 100, and that should give you your retention rate.

4. Lifetime Value

The lifetime value (LTV) of a customer is the monetary value of a customer over the course of their relationship with your business. This is a particularly useful metric for businesses that receive recurring payments or have repeat/loyal customers. There are a number of ways to calculate LTV, the most basic is by multiplying average order value (AOV) by the number of repeat sales, and then multiplying again by the average retention time (average customer lifespan, not to be confused with the CRR).

If your customers’ AOV is £60 per order, and purchase those items or similar once a month, and the average customer stays with your business for 4 years, then: £60 x 12 x 4 years = £2,880 LTV. The higher the lifetime value, the better for business.

5. CAC Recovery Time

The customer acquisition cost recovery time is the time it takes to recoup the costs of gaining new customers. To calculate the CAC recovery time in months, divide the CAC by the result of your average revenue per account (ARPA) multiplied by your percentage gross margin. Visually, the formula will look like:

If your CAC is £120, your ARPA is £70, and gross margin is 10%, then: 70 x 10 = 700; 120 ÷ 700 = 0.17 so it would take 17 months to recoup the costs of customer acquisition. The CAC recovery time will vary from industry to industry, although a standard CAC recovery time is 12 months or less, and the lower the better.

6. Marketing Originated Customer Percentage

The marketing originated customer percentage (MOCP) shows how much new business is as a direct result of marketing efforts. To calculate this metric, a CRM system would be useful as it collects customer conversions as a result of marketing. MOCP is a simple calculation that divides the number of new customers from marketing leads by the total number of new customers, then multiplied by 100.

For example, if you’ve received 20 new customers from marketing leads, and had a total of 35 new customers: 20 ÷ 35 = 0.57; 0.57 x 100 = 57%. Rather than just being a metric that shows how much the business grew, it reveals how much a business grew because of marketing.

Of course there are dozens of other metrics and calculations that can be used to help prove the cost and value of marketing efforts, the ones noted in this blog are just a few worth a mention. For more information on how you can grow your business with expert marketing solutions, speak to us today.