The financial services industry is fiercely competitive and has become more challenging as businesses move to provide their services online. These days you need to offer a distinctive proposition that sets your business apart. Developing a well-thought-out approach to your digital marketing can be difficult, considering it’s such a vast subject with so many ways it can be used in the financial services industry. What’s the best way to get started? This is a crucial question for new businesses to answer in order to assure their survival and growth. For larger, more established firms, digital marketing could make all the difference between expanding your market share and not.

What is marketing for financial services?

Financial services marketing refers to the use of a variety of strategies, processes, and tools to raise brand awareness and increase conversions for organisations in the financial industry. Through a succession of ongoing marketing campaigns, the process goes even further to acquire leads and turn them into loyal customers.

The two basic approaches for marketing financial services are:

• Traditional marketing – including TV, radio, print, and signs.

• Digital marketing – including both inbound and outbound channels such as blogs and pay-per-click (PPC) ads.

The majority of financial service firms will employ a combination of digital and traditional marketing strategies. Most, however, rely on traditional marketing channels due to legacy habits. This is changing as digital marketing strategies in the financial sector are proving to be a successful way to contact customers. It’s critical to understand the results of these new marketing efforts in order to properly execute them yourself. Effective financial services marketing raises awareness, lowers customer acquisition costs, drives down churn, and increases revenue.

The benefits of digital marketing for financial services

Widen your clientele

More and more consumers are taking to the web to research financial services, with searches for best online savings account rising by 60% last year. This shows an increasing demand for information about financial services online and indicates just how important it is for financial services to have an online presence.

Evaluate your services

The Internet, as a dynamic medium, is a two-way street. Apart from giving an ideal platform for financial sectors to sell their brand and feature their products, the online environment also allows you to evaluate your services and observe what works. You’ll have full access to analytics and other statistical data to track the effectiveness of your digital campaigns.

Receive instant feedback

In the finance industry, customer satisfaction is critical. The banking industry is driven by ensuring that customers are happy and satisfied with their services, and digital marketing for the finance industry does just that. From online posts to discussion forums, you’ll have a deeper understanding of what your customers want from your products and how you can improve your services to better customer satisfaction.

Cut down on marketing costs

There’s no denying that internet marketing and branding are significantly less expensive than traditional advertising and branding. Aside from the lower costs, financial organisations will have a greater reach and will be able to better target their audience. Banks and other financial institutions have resorted to digital marketing for the financial industry as a branding strategy to take full advantage of this cost-effective technique.

Are there any marketing regulations financial services need to adhere to?

The financial services industry, unlike other industries (except perhaps the medical sector), is subject to a raft of marketing standards and restrictions. While these rules are in place to safeguard customers’ interests, they also function as a considerable impediment to financial services marketing. Some examples are as follows:

• Affiliations: Appropriate affiliations must be indicated in all marketing, such as Member FDIC.

• “No advertisement may be misleading or deceptive, should be based on scientific data whenever possible, and cannot be unfair.” According to the Truth in Advertising Act.

• The Truth in Savings Act: Prohibits financial institutions from withholding information about checking, saving, and investment accounts from business owners or individuals.

• Fair Lending Laws: When it comes to credit, it is illegal to discriminate based on demographics or any other factor.

These are only a small part of the regulations. From a marketing standpoint, these create complex marketing environments that can result in a substantial charge if any of these rules are broken.

What business types can benefit from financial services marketing?

Financial services marketing can help businesses sell any type of financial service. These are just some of the entities:

• Retail and commercial banks.

• Companies and investment banks.

• Brokerages.

• Insurance companies.

• Companies that issue credit cards.

• Mortgage providers.

• Accounting and tax advisory firms.

• Equipment financing and asset-based lending.

• Factoring.

It is vital to remember that various organisations are typically subject to distinct laws and regulations. As a result, marketing operations must take into account the necessary regulations, depending on the type of company.

Tips for creating a digital marketing strategy for financial services

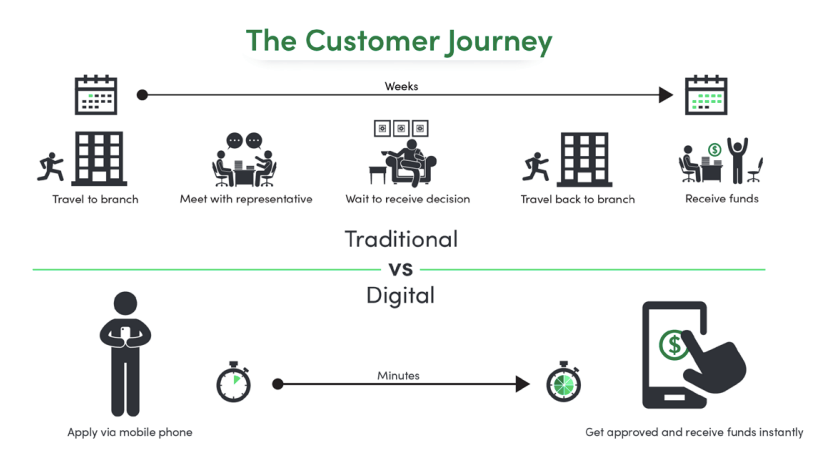

Control has transferred from the marketer to the consumer as a result of digitisation, a seismic change with substantial implications for financial services marketing. Financial-related queries like financial planning and financial advisor have increased by 75 percent in the last two years, according to Google. This figure points to the same conclusion:

Digital is offering customers more control and authority over their financial decisions. What can financial service providers do to adapt to this new standard? By adapting marketing efforts to a digital-first consumer journey and evolving, modifying, and mapping them. A digital-first financial services marketing plan is required to reach digital-first consumers. This involves including the following approaches into your overall strategy for financial service providers.

Embrace digital marketing

Traditional marketing has long been used by financial service providers, however, depending only on traditional channels is now a losing approach. The only method to reach a digital-first consumer is to use digital marketing techniques such as pay-per-click (PPC) advertising, email marketing, search engine optimisation (SEO), search engine marketing (SEM), content marketing, and social media marketing. Furthermore, digital marketing must be elevated to the same level as traditional marketing, if not higher, by receiving an equal or greater number of resources. It is no longer sufficient to handle it as an afterthought.

Go omnichannel including social media

Omnichannel digital marketing is a hot topic in the digital marketing world, and for good reason. According to Omnisend, omnichannel marketing efforts generate 19% engagement against 5% for single-channel ads. Similarly, when compared to single-channel campaigns, they generate a 90% greater retention rate. This means that campaigns for financial services must provide a seamless experience across websites, mobile applications, text messaging, email, social media, and other digital platforms. Integrated campaigns must also respond across several touchpoints, such as adjusting to customer interactions. When a customer opens a marketing email, for example, it triggers a text message containing a landing page.

Use content marketing to educate and empower customers

Only 8% of millennials trust financial institutions, according to a report published by Facebook IQ, a Facebook research firm. While there are a variety of causes for this mistrust, these figures suggest that financial service providers have an uphill task. Regaining trust confidence relationship marketing, is a strategy that educates and empowers customers to make the best decisions possible in their lives. Content marketing, an inbound methodology that develops high-value content (text, video, and audio) and attracts, convinces, and converts prospects, is the finest tool financial service providers can employ to achieve this. Customer education through an engaging content strategy was determined to be the strongest factor of client loyalty in financial services in one study.

Connect and engage

Consumers are moving towards more humanised businesses that care about the same things they do in an age of big brands and faceless companies. Customers can be effectively rallied around a brand and a common cause by including community marketing in a financial services marketing plan, especially on social media platforms. Community marketing is conversation-oriented, whereas other marketing approaches are generally conversion-oriented. A financial brand can differentiate itself and, as a result, pull ahead of the pack by gaining greater mindshare by engaging in meaningful conversations.

Standardise and optimise branding and messaging

Branding like logos, profile pictures, header images, and banner ads should all have the same design and concept across all media. Customers should feel a sense of consistency and familiarity as they connect with your business across numerous platforms, as these are important aspects in creating trust and acquiring more mindshare. Meanwhile, messaging should be consistent across all channels, based on a core messaging brief that guides all messaging. Apart from standardisation, branding and messaging should be tailored to each channel, taking into account:

• The importance of conciseness (Twitter).

• Imagery (Instagram).

• Visual and audio (YouTube, Facebook, and webinars).

• Possession of power (LinkedIn and influencer marketing).

• Search engine optimisation (Website and business blog).

Create digital experiences that are frictionless

A financial services marketing campaign’s performance can be harmed by imprecise content and visuals, as well as unclear navigational systems. With higher friction (the difficulty of performing a job), customers are more likely to leave the website, app, or profile and visit a competitor. In fact, after a negative customer experience, 88% of online consumers are less likely to return to a website. The following are examples of a simplified digital experience:

• Getting rid of unnecessary steps in navigation (e.g., linking directly to a download instead of to a download page).

• Web pages are optimised to load quickly on both desktop and mobile devices.

• Analysing and improving the overall digital experience based on customer data and analytics on a continuous basis.

Personalise all touchpoints

According to Marketo analysis, generic marketing blasts irritate 63% of consumers. In contrast, 79% of respondents indicated that they would be more likely to interact with a business that gave them offers based on previous encounters. Personalised marketing takes into account the customer’s identity, the actions they have made, and what they are likely to do next. Financial services companies should take advantage of the vast amount of consented data they have access to in order to create such experiences. Personalisation via email automation is low-hanging fruit in this aspect. Financial services may execute effective campaigns that feel customised for each customer with a carefully developed drip campaign. Personalisation, on the other hand, must go beyond simply mentioning the customer’s name in the greeting. Connecting the dots between actions, such as delivering a link to a relevant blog post, case study, or infographics that further educate the client based on a recent query, is an example of deeper personalisation.

Optimise the customer journey

Financial companies can employ customer journey optimisation to cut their marketing expense while increasing conversions. Companies that invest in customer journey management improve marketing-driven revenue by 25% year over year, lower service expenses by 21%, and shorten the typical sales cycle by 17%, .according to an Aberdeen Group study. The following are some of the techniques available:

• Customer segmentation based on data.

• Journeys that are optimised for each target audience.

• Customer journeys for each group are linked to customer service touchpoints.

• Investing more in the middle of the funnel rather than just the top and bottom.

Leverage technology

CRMs, chatbots, artificial intelligence, email automation, and real-time analytics are no longer a nice-to-have for financial service providers, but rather a must-have. However, without a clear strategy, marketing automation technologies should not be used. Chatbot, for example, grew by 92% in 2019, but 60% of customers would prefer to speak with a live person rather than a chatbot. Adopting marketing automation successfully necessitates:

• Evaluating your customer base.

• Setting aside a budget to see the project through to completion.

• Understanding the quality of the data collected (is it worth the investment?).

• Ascertaining if you have the necessary resources to fully utilise the technology.

Collect marketing data and analytics

Understanding the return on investment (ROI) in financial services marketing is critical for making the right investments. However, without data, gaining this perspective becomes difficult. According to a Neustar analysis, top-performing efforts (those that outperformed growth forecasts by 25% or more) were more data-driven than lagging campaigns. This involves merging consented data from CRMs, social media, email, and other channels into a unified data structure that may deliver actionable insights for greater marketing ROI for financial service providers. Adopting data-driven marketing can boost ROI and provide clients with better-personalised experiences, which is an important component of overall business success.

Master financial services

Pay-per-click (PPC) advertising for financial services is subject to regulations as well as advertising restrictions. As previously stated, financial service providers are required to follow a rigid code of conduct set forth by several regulations. Furthermore, ad networks such as Google limit the advertising of financial services. Google, for example. Prohibits the promotion of short-term loans (such as payday loans), credit repair services, or personal loans with high APRs. Financial services have a substantially higher cost-per-click (CPC), with certain keywords costing as much as £50 per hit. It’s critical to understand and manage PPC if you want to keep your ad revenue. Investing in high-impact PPC advertising is your best bet.

Partner with a financial services marketing agency

Internal digital marketing teams help larger financial service providers, such as commercial banks, push their marketing agendas. Partnering with a financial services marketing firm is a better option for a small business with limited resources than depending on limited internal resources. Using a digital marketing firm means working with a professional team of financial services marketers who are up to date on the newest trends, tools, and techniques in the industry.

Digital financial service marketing can be a significant growth centre for a financial services company, but only if it is properly understood and effectively applied. Without a solid strategy in place, more money will be spent on acquiring leads rather than nurturing and converting them into loyal customers and advocates. The key to success is to assess internal financial services marketing resources and strategies and determine what gaps need to be filled in order to achieve the desired return on investment.